Not that I’ve been diligent, but I’m going into surgery so won’t be posting for a while

-

Recent Posts

Recent Comments

Archives

Categories

Not that I’ve been diligent, but I’m going into surgery so won’t be posting for a while

As reported by Bloomberg News (Margaret Cronin Fisk in Detroit & Brad Broberg in Seattle):

Once again, it would appear that Bank of America’s lack of consideration for America’s cetizenry has been demonstrated. This time Bank of America Corp.’s ReconTrust unit “allegedly” failed to conduct foreclosures as a neutral third party as required by law, Washington state Attorney General Rob McKenna said in a lawsuit. For details on this issue please go to:

Maybe, at long last some semblance of “justice” will be handed out to one of the group of “too big to fail” institutions, as a result of their “alleged” disregard for entities other than their own corporation. Although, given the damage they and other Commercial and Investment Banks have caused to America and its citizens, it hardly seems fitting that AG McKenna is only asking $2,000 per violation, of which there are “alleged” to be thousands.

I’ll be very interested in seeing what the actual disposition of this suit and you can be very sure I’ll report on it, assuming I’m still around, when it eventually occurs.

I can’t say that this is too surprising, I only wish that the Banking giants (commercial and Wall Street), could/would be held accountable for their contribution to this mess we’re in:

Read and enjoy

http://www.housingwire.com/2011/09/01/treasury-withholds-hamp-funds-from-bofa-chase-again

Interesting Article: Seems to repudiate the Growth Management Board’s dictums.

Growth management hasn’t worked, analyst says

By Rachel Pritchett, Kitsap Sun

SILVERDALE — Growth management acts haven’t worked and should be retooled, a leading Northwest economic analyst told local Realtors on Friday.

“If growth management had been a really good idea, we’d see some results by now,” Michael Luis of Michael Luis & Associates told the Kitsap County Association of Realtors meeting at the Silverdale Beach Hotel. “I think it’s time to re-examine growth management.”

Luis’ visit was funded by Washington Realtors.

The acts, many of them around 20 years old now, were intended to concentrate density in urban centers, reducing sprawl and traffic congestion.

But huge public investment in public transportation has brought only minor change in people’s driving habits in the past 20 years, he said.

And homebuyer still prefer single-family detached homes, which translates into suburbs and cul-de-sacs and not increased densities in cities’ cores, he said.

“The public has spoken pretty clearly that they want to be in single-family detached housing,” he said.

Retooling growth management acts should include reducing lot sizes for single-family homes, he said, adding that builders have begun doing that, and buyers have not objected.

Retooling also should include ways to make workers’ commute a half-hour or less. That means putting housing in the same subareas where people work.

Revamps of growth management acts should have incentives to make communities energy efficient. Luis predicted homebuyer will make that much more of a deciding factor than now.

His listeners asked him why Kitsap home sales were still in the dumps even though mortgage rates are low and affordability is up.

A lot has to do with Kitsap’s population, he explained.

Kitsap’s population has tripled since 1960, but it has now leveled off, he said. Kitsap had 251,133 residents in 2010, according to the U.S. Census.

Also, “People stopped moving here,” he said. He’s not sure why.

Those who are moving here tend to be younger and not ready to buy houses. But they tend to be more highly educated, and in time will buy and be able to afford more substantial mortgages. The biggest chunk of new arrivals to Kitsap are from California.

His audience agreed heartily when Luis said homeownership still is a good investment. A person who purchased a home for $100,000 in 2000 would have a $130,179 home today.

That’s better than stuffing it under a mattress, where the $100,000 would be worth $76,923 today, or investing in the stock market, where it would be worth $69,935, he said.

If you purchased your home before 2005 and are in for the long haul, chances are you’re still above water, he said.

As to when the market is going to turn around …

“I don’t know, but it’s going to happen.”

As I’ve mentioned in past posts, the news media seems to delight in broadcasting “dire” news to us these days, or maybe they always have and I just didn’t pay attention.

In any event, they’re at it again: Last month I recall hearing about the potential for a “double dip” in the housing market, new home starts were down and prices took a substantial drop. In addition, job growth had slowed.

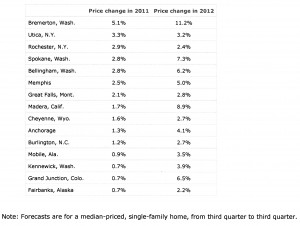

Real Estate, like politics is local and that is supported by a report I read in Rick Newman’s reporting for US News. Case Schiller is projecting that Washington State will have 4 cities in the top 15 cities for the greatest housing market appreciation in 2011 and 2012 (See chart below). The Bremerton/Central Kitsap market heads that list at # 1 with a projected 5.1% and 11.2% projected appreciation for 2011 and 2012 respectively.

On the natinal stage:

According the the National Assn of Realtors: Washington, DC, June 29, 2011

Pending home sales rose strongly in May with all regions experiencing gains from a year ago, pointing to higher housing activity in the second half of the year, according to the National Association of Realtors®.

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, rose 8.2 percent to 88.8 in May from an upwardly revised 82.1 in April and is 13.4 percent higher than the 78.3 reading in May 2010. The data reflects contracts but not closings, which normally occur with a lag time of one or two months.

This is the first time since April 2010 that contract activity was above year-ago levels, and the monthly gain was the strongest increase since last November when the index rose 10.6 percent.

At last, some good national news as well.

Teri Hewson

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The following chart is from the Fiserv Case-Shiller forecast of February, 2011:

I appologize for the blurred copy

While the Case Schiller housing value reports are projecting continued negative numbers for the greater Seattle area, the opposite is being projected for the close-by city of Bremerton.

Rick Newman’s (usnews.com) post of 2/2/2011 reports that the research firm Fiserv (Case Schiller) expects four Washington towns to be in the list of the top 15 cities where home values rise in 2011. Bremerton tops the list of 15 with a projection of 5.1% for 2011 and an 11.2% increase in 2012. Similarly, but to a lesser degree, they are projecting 2.8% in 2011 for Spokane and Bellingham and 0.7% for Kennewick. In 2012, they are projecting 7.3%, 6.2% and 3.9% for these three cities respectively.

I thought that this might interest (no pun intended) to some folks.

It’s amazing the swings that rates have taken over the years.

Thank goodness they’ve stayed low through these tough times.

According to Zillow, Poulsbo’s December 2010Â home values were Down 0.9% compared to November 2010 and down 6.7% compared to December 2009.

See http://www.zillow.com/local-info/WA-Poulsbo-home-value/r_22544//?scid=emm-021511_FebLocalProClaim-bab for more information

With regard to the underlying factors that are influencing the market in general, the news is good:

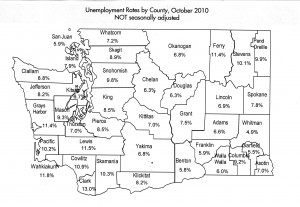

On the unemployment front, Washington State has an 8.5% rate whereas Kitsap County has a 6.7% rate compared to the 9.8% we’ve all heard about nationally (see below).

The actual number of “distressed” properties, nationally, that sold in the third quarter actually went down 25% from the prior quarter.

Likewise nationally, in the second quarter, foreclosure discounts were 26% vs 29% year over year. So hopefully this is a reflection of an improvement in the market more than an indication of price declines.

Also, as I’m sure you are all aware, the Stock Market’s 2010 performance is instilling

more confidence in the public as well.

Waterfront Values:

With regard to waterfront County-wide, we again saw an average sale price decline, but dramatically less so than previously (-2.15% vs 2009 –see attached graph – Kitsap County Waterfront Sales). This results in waterfront’s overall value decline at almost 35% from its peak in 2008 to now, almost 33.5% of which came in 2009.

There were, at the height of the selling season, over 250 waterfront homes on the market.

On a more positive note, there have been 138 waterfront homes sold this year, with another 10+ under contract. This exceeds the 99 and 121 sold in the preceding two years, respectively.