As I’ve mentioned in past posts, the news media seems to delight in broadcasting “dire” news to us these days, or maybe they always have and I just didn’t pay attention.

In any event, they’re at it again: Last month I recall hearing about the potential for a “double dip” in the housing market, new home starts were down and prices took a substantial drop. In addition, job growth had slowed.

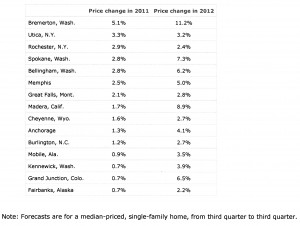

Real Estate, like politics is local and that is supported by a report I read in Rick Newman’s reporting for US News. Case Schiller is projecting that Washington State will have 4 cities in the top 15 cities for the greatest housing market appreciation in 2011 and 2012 (See chart below). The Bremerton/Central Kitsap market heads that list at # 1 with a projected 5.1% and 11.2% projected appreciation for 2011 and 2012 respectively.

On the natinal stage:

According the the National Assn of Realtors: Washington, DC, June 29, 2011

Pending home sales rose strongly in May with all regions experiencing gains from a year ago, pointing to higher housing activity in the second half of the year, according to the National Association of Realtors®.

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, rose 8.2 percent to 88.8 in May from an upwardly revised 82.1 in April and is 13.4 percent higher than the 78.3 reading in May 2010. The data reflects contracts but not closings, which normally occur with a lag time of one or two months.

This is the first time since April 2010 that contract activity was above year-ago levels, and the monthly gain was the strongest increase since last November when the index rose 10.6 percent.

At last, some good national news as well.

Teri Hewson

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The following chart is from the Fiserv Case-Shiller forecast of February, 2011:

I appologize for the blurred copy